In a webinar focusing on ‘Global Foodservice Trends’, hosted by Joanna Smart of Business Review, Jack MacIntyre, GlobalData’s lead analyst for foodservice, concluded the sector, while “extremely fragmented” remains valuable and with significant growth potential worldwide.

MacIntyre’s team have compared six years worth of data across 51 markets, interviewed 3,000 of “the most influential” opinion leaders in food and examined 500,000 menus globally in their extensive research of the global foodservice sector. The data, says MacIntrye is holistically and consistently benchmarked to ensure each methodology compares “apples with apples”.

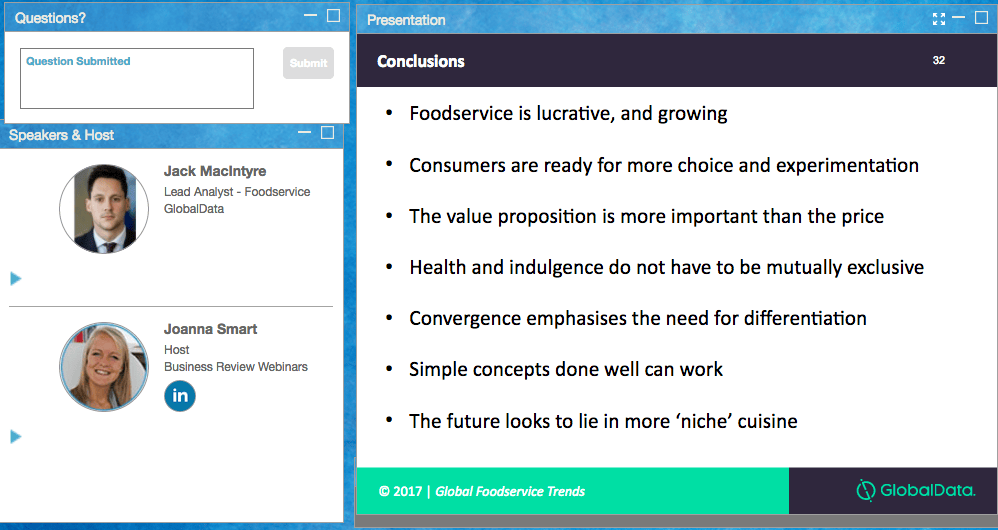

The report found the full year spend on global foodservice in 2016 was $3.8trn – more than ten times the combined revenues of Google, Microsoft and Apple – with North America contributing $720bn. That total spend is set to continue growing at a compound annual growth rate (CAGR) of 4.4%. “The market is lucrative, growing and ubiquitous,” says MacIntyre.

Health and indulgence

Eating out, the research concluded, is no longer a niche market around the world. The top line findings are that more than 25% of global consumers eat out of home at least once per week, 7% of consumers eat out of home two to three times per day, while 13% of “all eating occassions” are now out of home.

Health remains “a mitigating factor in global foodservice, rather than a driving force,” says MacIntyre. It is not the most important factor consumers consider when choosing to eat out. “Health is not the be-all and end-all in foodservice, which is classically about treating yourself and socialising. The received wisdom is that consumers either seek ‘healthy’ or ‘indulgence’. But ‘healthy indulgence’ is possible. There is a big trend towards greater transparency around food production – we are seeing the end of ‘black box’ production – and provenance associated with health.”

Convenience, says MacIntyre, is expected and demanded by consumers, so it is no longer a driver in itself. “Operators can win if they can offer ultra-convenience, fitting into consumers’ lifestyles and using technology to empower that. We’ve seen that with ‘click and collect’ and smarter packaging for food, both of which make the whole process less of an imposition.”

Consumers now, says MacIntyre, don’t view the price of food in isolation but as “part of the value proposition. The drivers to purchase are emotional and experiential. Discretionary spend on foodservice is generally more forthcoming than on grocery spend,” he says.

The move to convergence

There are, says MacIntyre, “well-held beliefs in specialisation in foodservice. People think segmentations are rigid. But in fact that’s not the case. ‘Specialisation’ is moving towards ‘convergence’ – or, everyone offering everything, better. Good coffee is now being sold by McDonald’s and pubs as well as in specialist coffee shops. That has led to quite serious challenges for operators in how to differentiate all of this.”

Global economic uncertainty will continue to spread some caution to consumers though, says MacIntyre, as they may “stick with what they know through times of austerity” but this will also be offset by growing experimentation for new cuisines in other quarters. The global foodservice market is, however “crowded, divergent and, in some cases, saturated,” says MacIntyre. Standing out from the crowd therefore, is vital. “Consumers are seeking adventure and experimentation.”

MacIntyre believes the humble hot dog may well follow the burger as a taken-for-granted food staple that could be reinvented by smart operators able to offer consumers a new take on an old favourite – at a much higher price. Customisation and premiumisation of food will also play a large role in this as consumers have increasing input in the preparation of their meals and drinks. This, says MacIntyre – who cites the example of Five Guys as an operator who have capitalised well on both the customisation and premiumisation of the burger market – is “a win-win for customers and operators. There are good mark-ups and margins to be had.”

The food delivery market meanwhile is, says MacIntyre, still small in a global context, but is set to grow twice as fast as traditional dining options.

MacIntyre believes while simple concepts done well will continue to work, consumers are ready for more choice and experimentation. “The future looks to lie in more ‘niche cuisine’. The days of American cuisines everywhere look to be tested,” he says.

Michael Jones