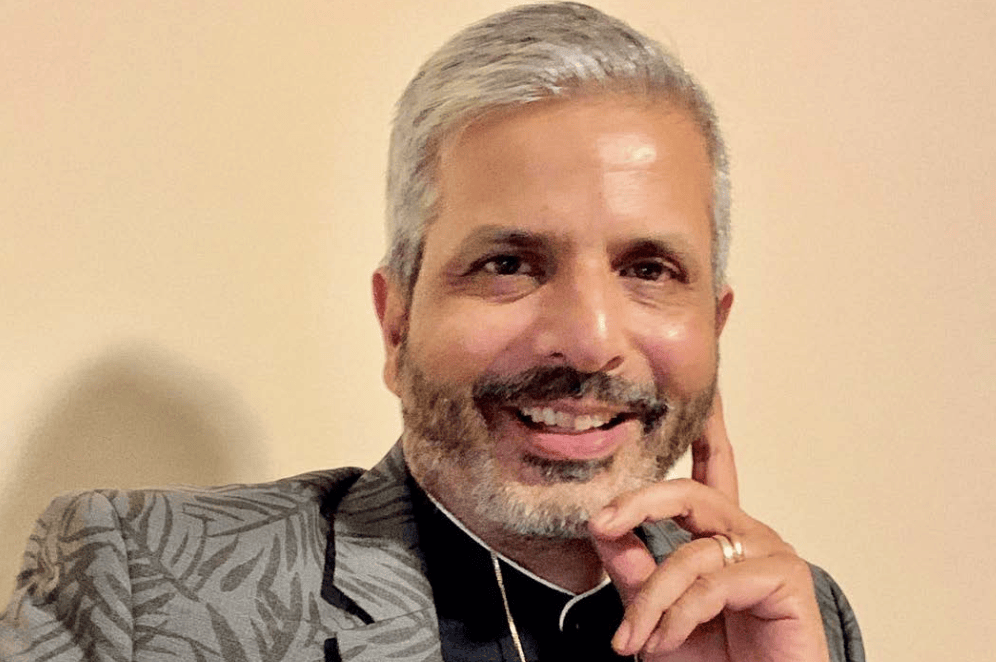

The Middleby Corporation’s announcement in April 2021 that it had made an all-stock transaction of Welbilt, Inc. caused more than a few ripples in the market. It is, comfortably, the biggest news to hit the foodservice equipment industry since the outset of the Covid-19 pandemic – and the kind of mega-deal that seemingly only arrives once in a generation. The company will have $3.7bn in combined 2020 sales and a vast geographical and product portfolio. “The foodservice industry is ready for change,” Timothy FitzGerald, CEO, The Middleby Corporation tells me via our Zoom call.

Why does the acquisition of Welbilt, Inc. make great business sense?

Timothy FitzGerald: The organizations fit together very well. Middleby has had a strategy of adding great brands, products and capabilities to the portfolio and, certainly, that is the case here. Welbilt’s got some terrific brands, but also a number of product categories that we are not in, as well as a lot of technologies that enhance what we are doing. So, from that standpoint, it really extends us. It adds a lot to the global footprint, which continues to be more and more important to our customers, giving us additional sales capabilities, localized manufacturing and other support services, which is an area that both companies have been investing in. With this scale, it allows us to make investments in those capabilities that our customers are seeking.

Why is this a great fit for The Middleby Corporation and its long-term future?

Timothy FitzGerald: We consider ourselves a leader in innovation, but I really think we’re at an inflection point in the industry where restaurants are now looking at different technologies and how they address different operating challenges that they have. This [deal] allows us to accelerate that innovation that both companies are investing in, as well as a broader portfolio of solutions. Last year, even during Covid, we said, ‘We’re incrementally spending $25m in investment in technologies that we weren’t doing before, and we need to do even more of that’. You could see the industry starting to pivot. So, this coming together allows us to really enhance, accelerate, and even invest further in technologies to support the foodservice industry.

Why are the market conditions favorable for such a big deal?

Timothy FitzGerald: It comes down to that pivot point. The industry is just coming through Covid and, as it recovers, the trends that were already starting to emerge, are accelerating forward. A lot of that has to do with the customer experience as well as the operating challenges for the foodservice industry as it recovers. They’re really being spotlighted right now. The foodservice industry is ready for change and customers are being forced to think differently. They’re willing to invest differently too and completely rethink their operations because their customer is now engaging with them differently as well – for example with deliveries, drive thrus, off-premise dining, virtual [restaurants] and ghost kitchens. They are just a variety of trends that were not there before. It is true of every industry: technology is exponentially growing and coming into our lives, but I would say foodservice is one area that has been more stagnant, frankly, than many other industries. But now that controls, IoT, automation and AI are coming into our industry, now is the time for that change because operators, probably for the first time are really thinking this through and saying, ‘Hey, there’s actually some practical applications here for us’. It’s our job to bring that to them, whether that is more traditional players like us, or players that maybe are not even in our industry.

Why is now the right time to make this acquisition?

Timothy FitzGerald: Middleby can really bring significant value to the customer, because we know foodservice. We’ve got a lot of the innovative solutions, can adapt new technologies, and can also bring a global portfolio of solutions with service capabilities and really understand our customers needs. So, I do think it really is the right time. We have the financial resources and the footprint to make investments to move the industry forward. We’re the right ones to do it and that’s part and parcel of this acquisition and bringing the companies together.

What additional geographical coverage does this deal give to Middleby?

Timothy FitzGerald: We’ve been investing heavily in Asia, but the Welbilt organization probably has a somewhat larger footprint there than we do. They’ve got some great sales and service capabilities throughout Asia. If you look into China’s as a hub, they’ve got two manufacturing facilities that offer localized manufacturing for a broad line of products, and they’ve got some significant engineering capabilities. So, that enhances what we have. We had also opened a factory [in China], just, prior to Covid and had made a recent acquisition there as well. The exciting part is, it is a broad portfolio of products and what they do is very different than what we do. And we’ve got some some pretty strong service capabilities. So, with our service infrastructure, it really allows us to support, not only our brands, but their brands as well, offering some solutions for our local customers as well as global chains in China, but then really taking that to the Asian region as a whole through some of the sales and service capabilities they have.

What about the rest of the world?

Timothy FitzGerald: In Europe, [Welbilt has a] complementary footprint. They’re strong in some markets that frankly, we have minimal presence, such as Germany as an example, which is obviously an important market. Then you’ve got some areas that are maybe more emerging, such as the Middle East where I would say both companies have a relatively small footprint, but when you put it together, we can better serve the region.

Which Welbilt brands are you personally excited to bring into the fold?

Timothy FitzGerald: I’m excited about all the brands, so I’m not going to pick favorites here. But here at Middleby, we really believe in brands. Across multiple business segments, in commercial foodservice, residential and food processing, we have been very good stewards of our brands. We focus on continuing to put the brand first, promote it, and allow for investment in innovation. And that’s one of the things that we’re excited to continue to do with Welbilt.

Do you foresee any sort of streamlining between the two organizations in the future?

Timothy FitzGerald: Our intent is to keep all the brands – it’s a great portfolio of brands, so absolutely, we would keep all of them. Middleby runs very decentralized. Our manufacturing and brand product strategy is really independent, and we expect that will be the case here. Our strategy has not been to centralize and create matrix organizations, pulling the autonomy out of the brand – it’s very much the opposite. What we do try to do is surround the brands with capabilities, resources and investment. We do get the benefit of economies of scale though. So, if we invest in IoT or controls, we can infuse that into a brand. Or, if we invest in international offices and that gives a brand an outlet to go into other markets, that is a benefit.

Middleby just opened up an Innovation Center in Dallas. We bring all the brands there, and that gives our customers a hands-on experience. It’s a kitchen that’s made for ‘you’. You can set up your kitchen and think about how to put together a customized, unique solution to suit your needs. We also support not only with menu and culinary, but with installation and service support. The Center was a $10m+ investment and it’s multi-million cost to operate each year. Investments like that, the brands can’t make independently, but they all benefit from it, so we continue to move forward.

We’re also investing a lot in digital. Education is a big thing, as is thinking about how we engage with customers and really making sure we can bring the right solution to help them with their menu, shrink their kitchen, reduce labor and run more energy efficient. A lot of those are tools that have to be developed and invested in. It’s really leveraging all of that around the brands and that’s where our organization has benefited and we expect a lot more of that, to come out of this transaction.

Do you ever worry about the company now becoming too big, losing that kind of fleet-footed agility to move quickly?

Timothy FitzGerald: I worry about that every day and that’s not a new concern. Middleby’s been growing for a long time, and we’ve become a pretty large organization on our own. That is why the culture and the strategy around decentralization is so important to us. One of the reasons why we want to continue to ‘act small’, even as a larger organization, is because people are very important to us. They are to every company, but they truly are here. We’re a people-driven company, not a process-driven company. That’s where we empower our people in the brand, so they can make decisions, be nimble and move quickly. I think we’ve done a good job with that. We want to be close to the customer and having kind of that decentralized culture is a key element of that.

The integration will come together pretty well because we are very commercially focused and we care about the customer. I think the global brands [will] probably have more autonomy after the transaction, than they do today. I fiercely want to make sure that we don’t become a prototypical large organization that’s not nimble, but is keeping it local and our businesses are empowered and very focused on the customers. That’s critically important to us in our culture.

Do you think the deal might inevitably spark further M&A and consolidation elsewhere in the industry?

Timothy FitzGerald: Consolidation has been going on for a while, so that’s not necessarily a new phenomenon. I would say it’s probably going to continue. That being said, there’s a lot of new companies that are coming up. It’s a much more global landscape today than it ever was before. There’s probably even more new companies that are coming into the fold that wouldn’t have been there a year or two ago. It continues to be highly fragmented, even as consolidations have been ongoing for quite a while.

Is this deal likely to be the only M&A Middleby does this year?

Timothy FitzGerald: I would say we’re not done. Every year, we have more opportunities. It’s kind of exponential, partly because we’re in a lot more markets globally than we were before. Certainly, we’re in more foodservice segments – we weren’t in beverage, for example, five years ago, and that’s a phenomenal category. There’s a lot of new exciting developments. So, we continue to extend into adjacent areas, then we can provide our customers more value and do a lot more technology sharing across the brands and the platforms. You’ll continue to see us really think broader, more creatively, and not only adding complimentary brands and categories, such as Welbilt, but really bringing solutions and technology into the portfolio that allows them to really accelerate the offerings they have to the customer.

What does success look like? Why are you excited for the future of Middleby, but also the industry overall?

Timothy FitzGerald: The industry is changing and pivoting and the solutions we can provide to them today, and then in three, five and 10 years from now are evolving very rapidly. I think those are going to be game-changers. And that’s one of the reasons this transaction is really the beginning of it. It provides us with tools and capabilities. It’s not like this is a fait accompli – I would say it’s very much the opposite. It positions [us] so we can start thinking about the future, today. It’s going to be an exciting time for the the restaurant industry, because of the changing dynamics and landscape right now. We could be a big part of that, really supporting our customers.

How will our readers – the consultants – benefit Middleby’s enhanced portfolio?

Timothy FitzGerald: I have to say that [in the past] Middleby was probably not as forward-thinking in terms of how we bring some of these solutions to the consulting group, but we’re very focused on that right now, creating a consulting program in the last 18 months [consultants can access that program, here].

Consultants are trying to carry unique solutions to the foodservice, as they’re helping design programs for their customers – which are our shared customer. So, being on the cutting edge, is a big benefit. We’re really trying to engage with foodservice consultants in that that regard, because their customers want the same thing: they want to know, ‘How do I change the operation? How do I become more efficient? How do I have a flexible, safer kitchen? Or address labor concerns?’ So bringing interesting, unique ideas that [consultants] can build around is something we’re focused on – and engaging with them on right now.

On our website, we have a whole area called Consultants Corner and we’re doing monthly training at the Innovation Center. That is something we’re really pushing – those forward-looking solutions to the consultant world so we can be engaged with them together and get those solutions out to the end-user.

Michael Jones