According to findings from the UK’s Catering Equipment Supplier’s Association (CESA), the mood of the British catering equipment industry has swung dramatically from 2017 to 2018, with many more companies feeling that the economy will struggle in the next twelve months.

The latest CESA Business Barometer, which surveyed members of the association at the end of Q1 2018, also highlights the change in priorities in terms of what businesses are most concerned about. At the end of 2017 it was price increases and inflation. Now it’s reduced consumer demand.

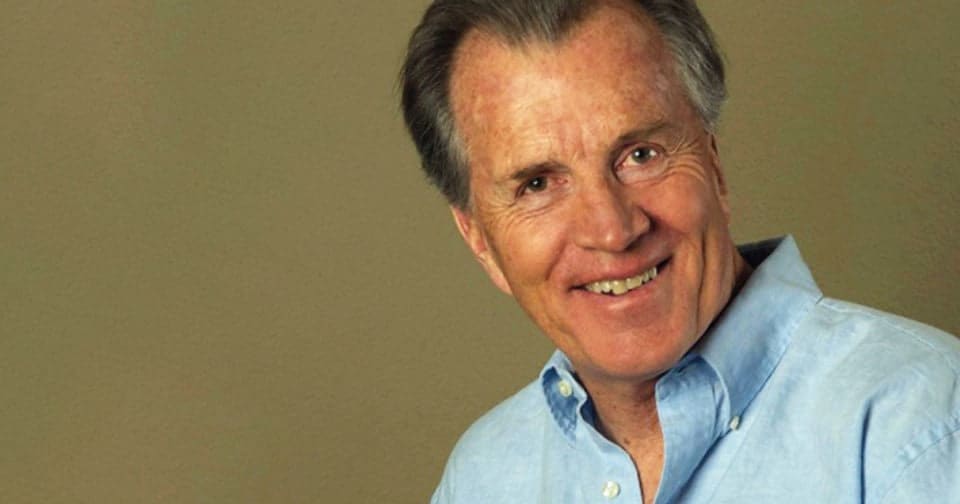

“Heading into 2018 there was an optimism about the economy,” says Glenn Roberts, chair of CESA. “However, this changed significantly after Q1, with only 14% of respondents seeing a positive outlook. Nearly 50% of respondents said they thought economy would not do so well over the coming year – compared to just over 20% in Q4 of 2017.”

Business prospects

There’s less optimism around their own business prospects, too. The survey found 40% of companies are “nervous or pessimistic about business turnover in the next year – compared to 24% in Q4 2017.

Reduced consumer demand jumped from number five to number one in the list of major business concerns. Uncertainty over the UK’s role in Europe remained at number two. Interestingly, raw materials prices dropped out of the top five altogether – perhaps because by now the worst has already happened. It was replaced by the need to retain the best people.

In terms of the priorities for the UK’s negotiations over Brexit, the derogation from the Working Time Directive remains respondents’ number one objective, with reduction of the UK’s payments to the EU budget at number two. Reduced regulations saw the biggest jump, moving from second to bottom in Q4 2017 to third from top in Q1 2018. Standards, access to skilled workers, free movement of people and access to the single market all feature as key priorities, too.

“It’s not all doom and gloom,” says Roberts, “but it’s certainly a holding pattern. For example, while fewer companies expect orders from the UK and overseas markets to increase, more expect them to remain the same. The same is true of staff numbers, capital investment and R&D. We’re not going backwards, but we’re certainly slowing down.”

Furter details:

The CESA Business Barometer is a survey of CESA members, carried out every quarter, to give a snapshot of the market and business expectations for the catering equipment industry. Copies can be obtained by contacting CESA.

The Catering Equipment Suppliers Association (CESA) is the authoritative voice of the catering equipment industry, representing over 190 companies who supply, service and maintain all types of commercial catering equipment – from utensils to full kitchen schemes. For more information on CESA visit www.cesa.org.uk